Co-branded travel credit cards are one of the best ways to earn huge amounts of miles in a short amount of time. It is easy to earn over a hundred thousand miles a year by signing up for a few new cards every year. The annual fees are are almost always waived on these credit cards to encourage you to sign up.

However, after a year of using the card you can expect those fees to kick in. These fees can range from around $60, $100, or more depending on the card. Of course many people will simply pay the annual fee because they find value in keeping the card. For example, many cards come with perks such a free checked bags or priority status. If you check your bag (I try to avoid checking at all costs) then you will quickly earn your annual fee in checked bag savings. For those of us who don’t want to pay the annual fee there are a few options.

Set a Reminder Before Annual Fee is Due

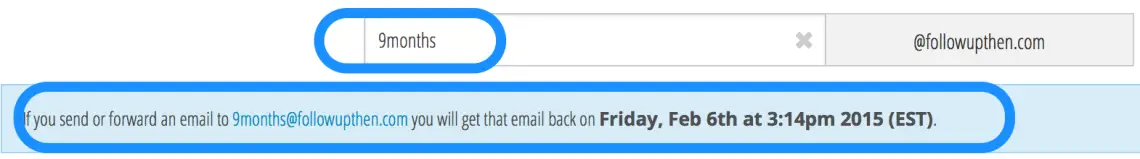

The first step in avoiding your annual credit card fee is remember when it is due. I like using FollowUpThen to remind myself when to call my credit card company. I would recommend setting the reminder to email you 2-3 months before the annual fee is due. This way you have time to negotiate and go over your options.

FollowUpThen is a simple and free email reminder that will send you an email when you set it to. Simply email it the date or when you would like to receive a follow up email.

Go to FollowUpThen and enter the number of days, month, or weeks when you would like to be reminded. Then click the email link generated by the site and write yourself a reminder email.

Reminder: Do not cancel you card immediately after receiving your sign up bonus. This is a red flag and looks very bad for future applications. Wait until there are about 2-3 months left before your annual fee is due. This is a good time to call your bank and negotiate the fee.

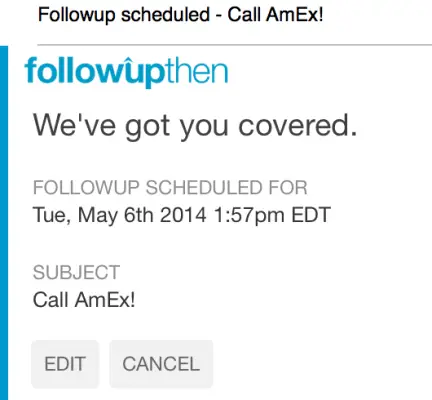

You will receive a confirmation email with your reminder. Now you can forget about that card for a few months because has you covered.

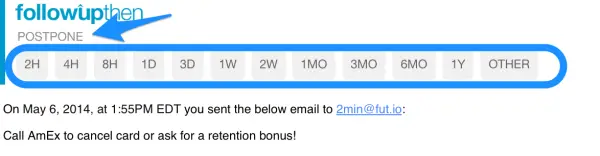

When it comes time to cancel your card or try to avoid the annual fee you will get a reminder email. You can postpone it or mark it complete once you have handled all of your travel credit cards.

How to Avoid Paying Your Credit Cards Annual Fee

Many travel hackers churn and burn cards annually. This is an acceptable method to earn frequent flyer miles quickly every year over and over again. However, it will make an impact on your credit score. If you are applying for a loan or making a large financial commitment in the near future it would be wise not to open and close multiple cards a year. It is possible to maintain excellent credit as a travel hacker and you can avoid the annual fees.

Remember 30% of your FICO score is determined by your credit utilization ratio. This is the percentage of available credit you are currently using on all of your cards. It compares the amount of credit being used to the total credit available (source: creditcards.com).

This will cause a minor dip in your credit score but it will rebound quickly and is not a large concern.

Closing cards will also impact your credit history. 15% of your FICO score is made up of your credit history which is another thing to consider when closing a credit card.

Option 1: Ask For the Annual Fee to Be Waived Again

This is as simple as picking up the phone and calling your bank. Explain to them you really like the benefits of the card but you can’t justify the high annual fee. They want to keep you as a customer and are often happy to negotiate and will waive the annual fee.

Option 2: Ask for a Retention Bonus

What is a retention bonus? A retention bonus is when the credit card company offers you something in return for not closing your card. This usually comes in the form of points, frequent flyer miles, or a statement credit. If you are going to keep the card they might reward you for it and it never hurts to call and ask.

Retention bonuses vary from bank to bank and person to person. Always call to ask for a bonus before you cancel your card. If you don’t get the offer you want call back again. Be persistent.

Option 3: Downgrade Your Card

Let’s say you signed up for Citi ThankYou Premier ($125 annual fee waived first year) with a great sign up bonus and an annual fee. You earned 50,000 bonus points but now it is time to pay the $125 annual fee. You enjoy the perks of the card but do not want to pay the high annual fee. Call your bank and ask if you can downgrade to the Citi ThankYou Preferred Card.

Typically you can keep your credit limit the same and you won’t hurt your credit by downgrading. The negative is that you will lose some of the perks you had with the better card.

Option 4: Cancel Your Credit Card

If you are not satisfied with the offer from the credit card company and don’t see value in keeping the card you should cancel it. There is no reason to pay a high annual fee that offers little return. Apply for a new card with a high signup bonus earning points and miles towards free flights.

More Travel Credit Card Options

Credit Cards with Big Sign up bonuses

More Credit Card info from Travel Card Pro